Unlocking the Roof Over Your Head

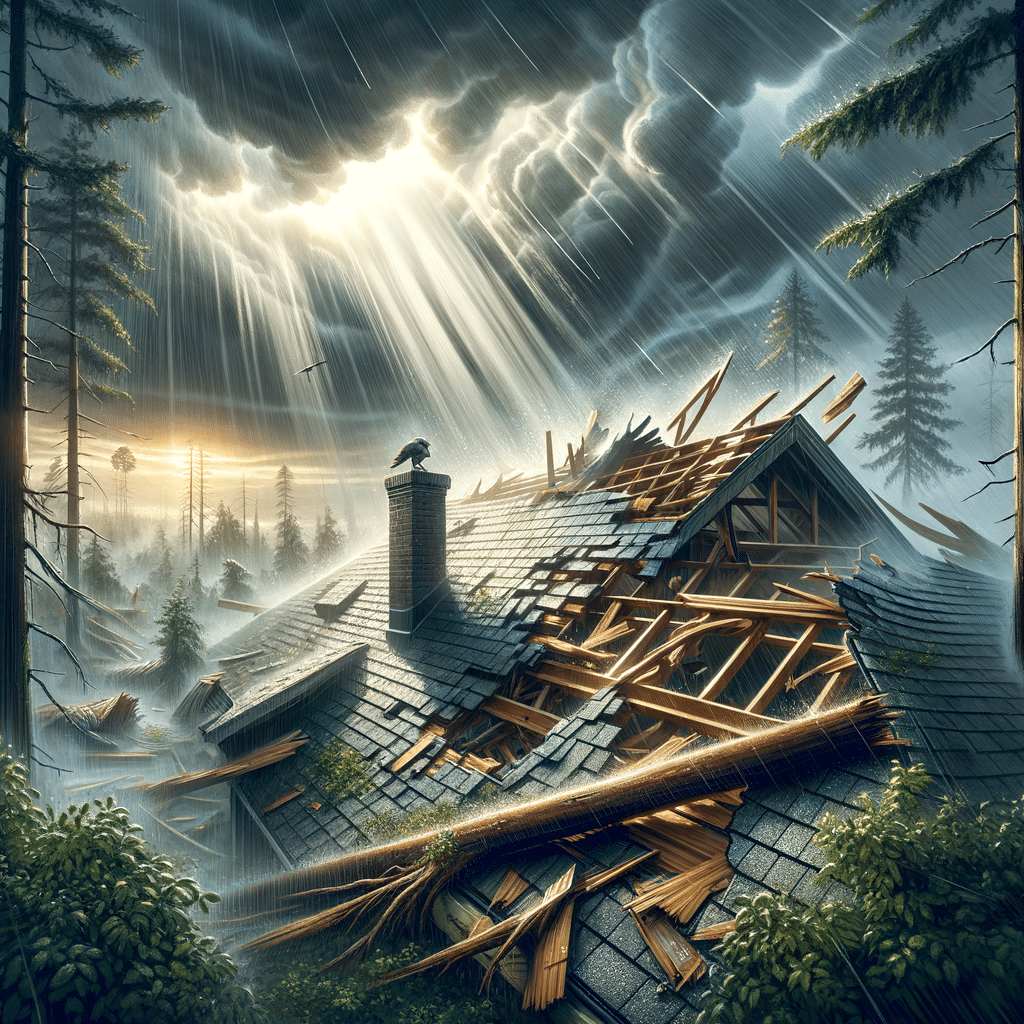

When it comes to protecting your home, there’s nothing quite as critical as a sturdy and reliable roof. Residents of King County understand this all too well, especially when the Pacific Northwest weather throws its unpredictability into the mix. Securing the right financing for roof repair or replacement doesn’t just safeguard your family from the elements; it also protects your most valuable asset. Yet, many homeowners feel overwhelmed by the prospect of financing, unsure where to turn or what options are available to them. Timing is everything, and making informed decisions now can save a lot of stress and expense down the line.

Contrary to what you might think, finding financing for your roofing project isn’t as daunting as it appears. There are a multitude of options tailored to meet the diverse range of needs and situations of homeowners in our community. From traditional bank loans to innovative financing programs, certain paths can grant you the means to begin necessary repairs without immediate financial strain. But it’s not just about finding money; it’s about understanding the long-term implications of your investment. Seeking out comprehensive solutions that align with your financial goals and the long-term welfare of your home is key to successful roof financing.

As we delve into the details of Roof Financing Options King County, remember that this guide isn’t just about numbers and contracts. It’s a roadmap for maintaining the integrity of your dwelling place while fostering financial peace of mind. We will explore the variety of financing choices, discuss how to navigate the complexity of each option, and help outline the benefits that support your decision. Every household’s situation is unique, which means there is no one-size-fits-all solution; rather, a tailored plan that aligns with your specific circumstances and protects your home investment. By the end of this article, you’ll be equipped with the knowledge you need to make the right decisions for your roof and your budget.

Exploring Your Financial Pathways

Diving into the world of roofing finance carries a promise of both protection and prosperity for your abode. For many homeowners, a deep dive into credit history and available equity marks the beginning of the journey towards a well-financed roofing project. Understanding these factors is critical, as they heavily influence the terms and accessibility of loans and financing programs. By carefully assessing your financial health, you’ll be empowered to choose a plan that not only funds your roof but also fortifies your fiscal future. Consideration of one’s creditworthiness ensures that the chosen financing solution is not only immediate relief but a smart economic move.

When it comes to tailoring a financing plan, it’s often believed that only brand-new installations warrant the effort. However, that’s far from the case. Repair programs, maintenance plans, and partial replacements all fall within financing capabilities, making diverse options available for different extents of roofing needs. Whether you’re looking to patch up a few shingles or opt for full-scale installation, there’s a financial strategy for every scenario. A clear understanding of these versatile options can facilitate a smoother pathway to safeguarding your home without the pressure of upfront payment.

Amidst the range of financing choices, what remains constant is the inherent value added to your home through these improvements. This is more than a mere transaction—it’s an investment into the longevity and resilience of your property. Enhancing your home’s roofing not only reinforces its structural integrity but also contributes significantly to its market appeal and overall worth. As you consider the benefits of roofing finance, remember to weigh these long-term advantages against the financial commitment you’re about to make. Wise roofing investments not only shield your home from the elements but also strengthen its financial standing.

Finalizing Your Roofing Finance Strategy

As we solidify our discussion on roofing finance, it is crucial to contemplate the gravity of this commitment. Not only does it concern the immediate fiscal impact but also its consonance with your long-term financial blueprints. With a concrete, customized plan in place, you can be assured that the investment in your home’s roof is secure and sensible. The act of sealing a financial deal should fill you with confidence, knowing that you have taken a step towards fortifying your family’s shelter and legacy. Remember that this decision is an integral part of your household’s narrative, one that will continue to play out through the coming years.

Having grasped the myriad financing options available, it’s time to proceed with clarity and conviction. Be mindful of the terms and contingencies associated with each potential financing route—foreknowledge here is undoubtedly powerful. Always read the fine print, and when in doubt, don’t hesitate to reach out to trusted advisors or financing experts. After all, a well-educated choice in the present manifests as unwavering stability in the future. This prudent approach ensures that your roof can weather any storm, all while your finances remain under control.

In closing, we invite you to harness the insights and strategies discussed to bolster both your home and your economic security. If the process feels intricate or the details burdensome, remember that resources such as EY Contractors are available to guide you. Considering the ever-growing array of financial options, seizing control over your roofing situation has never been more achievable. Approach the task with an empowered attitude—the roof over your head is more than a basic necessity; it’s a testament to your foresight and responsibility. So take that step forward, invest in the integrity of your home, and stride confidently into a future under a well-financed, robustly protected roof.

Insights From The Experts

Tip 1:

Before applying for roofing finance, assess your current financial situation. The interest rates and repayment terms can widely vary, so it’s important to find an option that aligns with your budget and long-term financial plans.

Tip 2:

Explore local government programs or grants available in King County. These can sometimes offer more favorable terms or interest rates, especially for energy-efficient roofing upgrades or repairs following natural disasters.

Tip 3:

Inquire about payment plans directly with roofing contractors. Many contractors have partnerships with finance companies or offer in-house financing options that might not require as stringent credit checks.

Tip 4:

Consider leveraging home equity for your roofing project. A home equity line of credit or loan could provide a substantial amount of money with potentially lower interest rates than a personal loan or credit card.

Tip 5:

Always read the fine print when it comes to financing. Understand all the fees involved, the precise term lengths, and what happens in case of early repayment or default. It’s crucial to make an informed decision to avoid any surprises down the line.

Expert Answers to Your Roof Financing Queries

What financing options are available for roofing in King County?

Several financing solutions are at your disposal, including traditional bank loans, contractor financing, home equity lines of credit, and even specialized grants or government programs designed for home improvement.

Can I use home equity to finance my roofing project?

Yes, many homeowners leverage their home equity through loans or lines of credit to fund significant repairs or replacements, potentially benefitting from lower interest rates and tax-deductible advantages.

Are there financing options for both roof repairs and replacements?

Absolutely, financing is not limited to complete roof overhauls; many programs and lenders offer funds for partial repairs, maintenance, or smaller-scale improvements.

What should I know about the terms of a roofing loan before signing?

It’s essential to understand the interest rates, repayment schedule, any associated fees, and what happens if you decide to pay off the loan early or default on payments.

Does King County offer any roofing grants or government-supported financing programs?

King County residents may have access to various state or local grants and incentives, especially for energy-efficient upgrades or repairs following environmental damage.